MEADOWBROOK FARM HOA RENTAL POLICY

A rental policy clearly defines what restrictions your homeowner’s association has concerning rentals. It lets owners know whether they can rent out their homes or units and if there are any limitations attached to rentals.

You might wonder, though, why an HOA rental policy is even necessary in the first place. To understand the reason, you must first understand how homeowners’ associations work.

A homeowner’s association is responsible for maintaining the community. That includes performing or hiring someone to perform various tasks such as landscaping, cleaning, maintenance, etc. An HOA does this with the primary goal of preserving property values. And unrestricted rentals can affect property values in a negative way.

TENANT REGISTRATION

Owners if you decide to rent you must submit the names and contact information of their tenants and guests to HOA by email or letter to include name, address, email, Vehicle info and phone contact within 72 hours of rental.

ENFORCEMENT PROCEDURES

All HOA policies to include Covenants, Community Rules will be enforced. Only Homeowners will have a right to vote on Community matters and board elections. The Homeowner will be responsible for the resident abiding by all Homeowner Association rules. All residents are responsible for HOA covenants and Community Rules. If there is an issue the homeowner is ultimately liable for correction of disputes between renter and HOA. All legal avenues as outlined in the Covenant and community rules apply.

HOA ASK FOR A COPY OF THE LEASE

All Homeowners will be required to furnish a copy of the Renters lease, which will be maintain by the treasury only. Homeowner will be responsible for all dues. If dues are not collected, then the renter will be held responsible.

ENFORCEMENT PROCEDURES

Firstly, the HOA usually sends a warning letter to the tenant and the property owner notifying them of the rule violation. If the tenant continues to violate the rule after receiving the letter or fails to comply within the stipulated period, the HOA might take further action. This could involve levying a penalty, such as a fine, or taking legal action to enforce compliance.

The consequences for failing to comply with HOA rules can vary depending on the specific HOA’s bylaws and the nature of the violation. Generally, the HOA has the right to impose fines, and these fines are often applied to the homeowner’s HOA account. In this case, the property owner, rather than the tenant, is usually responsible for paying these penalties. The homeowner can then attempt to recover the cost from the tenant based on their lease agreement. Severe or repeated violations could result in the HOA pursuing legal action against the homeowner or potentially the tenant.

Notification of violations, dues and voting matters will be sent to owner of record. If Owner cannot be notified/contacted renter will be notified and billed for any back dues, again owner is responsible if legal action is pursued.

Landlord Measures for Compliance

Maintaining compliance with HOA rules requires active involvement from landlords. As previously mentioned, landlords should make tenants fully aware of HOA rules and regulations before they move in. Clear language in the lease agreement should spell out the tenant’s responsibility to follow these regulations. Lease agreements can also include provisions stipulating that breaking HOA rules constitutes a violation of the lease, which may then be grounds for eviction.

In conclusion

Being a landlord in an HOA community requires extra care, communication, and understanding to ensure you and your tenants abide by the community regulations. By doing so, a harmonious and mutually beneficial relationship can be maintained with the HOA, thereby adding value to your real estate investment.

Owner Signature……………………….. Date

Renter Signature……………………….. Date

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Date: April 3, 2025

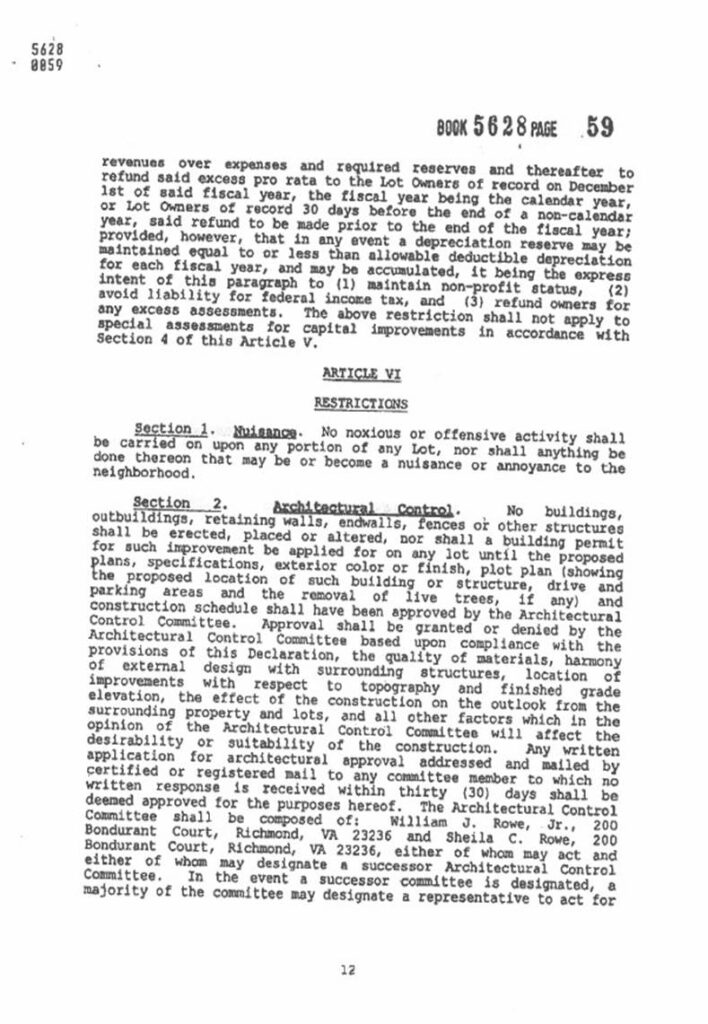

COVENANTS

Left Blank Intentional

Left Blank Intentional

Left Blank Intentional

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Date: Feb 16, 2025

REF: Disclosure Packages

The amount of paperwork required during the home sale process is staggering. When you’re buried under a mountain of 180 pages related to the deal, it’s easy to neglect a stack that seems to hide on the periphery of the transaction: the Homeowners Association (HOA) documents/ disclosures. Put simply, it’s a set of documents and disclosures provided by the HOA to the buyer or seller of a property within the community. This package, also referred to as an HOA disclosure package or HOA resale certificate, contains a wealth of information that can impact your transaction and provide valuable insight into the community.

What must be disclosed:

HOA must be transparent and forthcoming with the rules, regulations, and financial state of the HOA governing block.

The new owners also need to know about the restrictions on what they can do to their new home (like the type of holiday decor they can display in the yard or what color they can paint their house exterior) and which types of violations will result in fines/violations.

The packet must contain all the association rules, any amendments they’ve made. These details are all included in the HOA disclosure documents, along with the HOA’s financial reports.

These financial documents give the new buyers insight as to how well the HOA manages its finances. They also spell out who’s in charge of the association, and how to get in touch with HOA board if there are any issues.

Why do HOA documents need to be disclosed?

The two most obvious answers to this question are pretty straightforward. HOA documents need to be disclosed because:

- The new homeowners need to know the HOA’s Covenants, Conditions and Restrictions (CC&Rs) so they can abide by them. The package can also provide information about any ongoing or upcoming community projects, such as repairs, renovations, or other initiatives.

- The new homeowners need to know when, where and how much they need to pay per month in HOA fees.

The third reason is a little less obvious, and it’s directly related to those important financial statements:

- The new homeowners need to know if either you or the association are in any financial hot water.

“The disclosure documents should include a copy of the association’s declaration/master deed and answers to a set of standard questions,” “The questions usually cover issues relating to the association’s financial status and whether the home has any outstanding debt to the association.”

The disclosure documents will also indicate how often the association is allowed to increase dues or authorize assessments.

Your standing with the HOA will also be reported within the disclosures. If your home is not in compliance with the association’s CC&Rs, the new homeowners need to know — especially if it’s going to cost them down the line.

What happens if I’m behind on HOA fees when I sell my home?

The party responsible for paying this debt can depend on the legalese in the HOA documents, state laws and other minutiae.

If you do owe money to your HOA, selling your house does not release you from that debt because it is your personal liability. But that doesn’t mean your buyer is in the clear on that old debt.

“If the home has unpaid common assessments/maintenance fees, the amount due will need to be paid at closing or the purchaser will become liable for that debt,”

Who is responsible for obtaining the HOA disclosure documents and how much does it cost?

Given how much vital information is in those lengthy HOA disclosure documents, you won’t be surprised to learn there is a cost to obtain them.

“A declaration usually is around 80-125 pages, “The cost for disclosure is presently $125.00 So who’s on the hook to pay for those HOA disclosure documents? Typically you, the seller.

Avoid HOA snags with the right documents

Selling a home that’s part of an HOA can add complications during the home sale process — and sometimes those complications are big enough to tank the deal completely. The best way to avoid that type of setback is with current, professionally-prepared HOA disclosure documents. Work with an experienced real estate agent to ensure you have the most up-to-date documentation for a smooth closing.

HOA documents FAQ

What HOA documents do I need to provide when selling my home?

Typically, sellers need to provide the latest HOA financial statements, the Covenants, Conditions & Restrictions (CC&Rs), meeting minutes, bylaws, and any rules and regulations. Check with your real estate agent or HOA for specific requirements.

How can I obtain the required HOA documents?

Most HOA management companies have a process for ordering – processing documents, either online or through a direct request.

Are there costs associated with obtaining HOA documents?

Yes, many HOAs charge fees for providing the necessary resale package, which contains all relevant documents. The cost varies depending on the HOA and the urgency of the request.

Do I need to disclose any pending changes or assessments?

Absolutely. Sellers should disclose any known upcoming assessments, fee changes, or significant community alterations to prospective buyers.

How recent do the HOA documents need to be for a home sale?

Generally, the most current documents are required. It’s important to show potential buyers the latest financial health and rules of the HOA to prevent any surprises post-purchase.

MEADOWBROOK FARM HOA Process:

1. If real-estate agent selling home contact Meadowbrook Farm HOA P.O. BOX 34054, Chesterfield VA 23234 or POC 804-901-4636 for Invoice and disclosure package all dues must be paid.

2. If resident selling home contact Meadowbrook Farm HOA P.O. BOX 34054, Chesterfield VA 23234 for Invoice and disclosure package all dues/violations must be corrected or disclosed in the disclosure packet.

3. Treasury will verify dues paid any liens and HOA Coordinator will verify any outstanding violations that must be disclosed.